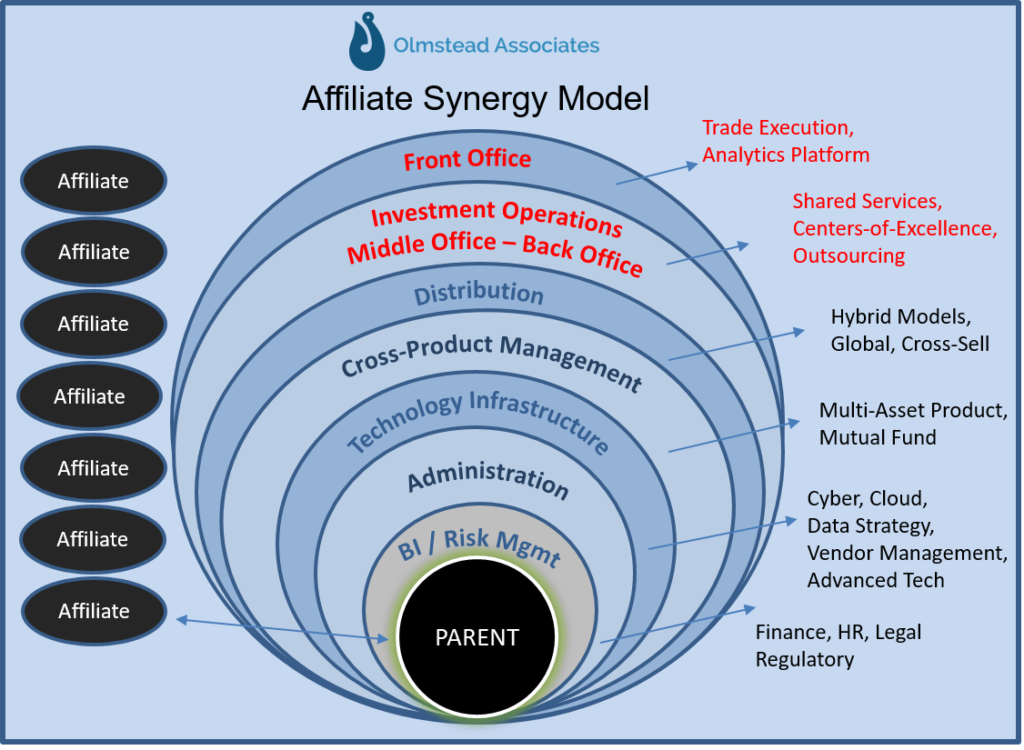

The multi-affiliate operating model is increasingly under review as asset managers seek synergies from their infrastructure to bolster their margins. Whether firms have intentionally structured a multi-affiliate business model or possibly find themselves running multiple platforms due to acquisitions, these redundant platforms are obvious targets to drive organizational agility while improving margins. Some of the initiatives intended to rationalize the models have been announced publicly and their stories highlight the need to have a clearly defined roadmap, buy-in across the impacted entities, and measurable goals defining success.

Historically, acquisitions and the resulting multi-affiliate ownership complexities have resulted in a hands-off approach between “parent” and affiliates ensuring there was minimal disruption to the “secret sauce” of the acquired firm. Typically, any attempt by the parent firm to intervene in the operating model was often met with resistance. An interesting trend emerging is the affiliate firms are initiating projects with the home office to leverage the capabilities, expertise, and scale of the parent. These first requests for support typically are driven by some of the overarching industry themes that disproportionately impact smaller firms such as regulatory, risk, compliance, legal, and finance, as well as technology challenges such as data management, disaster recovery, and cyber security support. These initiatives tend to address the lower hanging fruit and are often the necessary initial steps to broader collaboration.

We are now seeing a second wave of activities, again often driven from the affiliate upward, with requests to address broader operating model transformation opportunities. Across the spectrum of possible affiliate model decisions, the middle office is increasingly viewed as having the highest potential for impactful change. Parent and affiliates are jointly evaluating investment operations and technology platforms with the goal of building a single, leverageable platform for growth. This would enable them to unlock existing business constraints by addressing overly complex operating structures that impact their ability to generate new products and services for their clients. Below are a few of the options multi-affiliate firms consider:

- In-House Consolidation – Consolidate to a single operating platform and merge the various middle office operations teams. Often firms will leverage one of the larger affiliates to serve as the focal point of consolidation effectively creating centers of excellence to optimize their scale. This approach has the potential to drive significant savings while leveraging the existing knowledge that is essential in supporting customized front office services.

- Platform Consolidation – Migrate all middle office teams to a single platform without consolidating the operations teams of the various affiliates. This can deliver the benefit of technology scale as well as enhanced quality, consistency, and availability of data across all facets of the firm. It also can serve as a framework for integrating future acquisitions and new product growth to better leverage scale.

- “Opt-In” Model – Utilize one of the larger operational teams and middle office platforms as a base of consolidation that can be offered to affiliates. This provides the affiliates with a decision to “opt-in” to a centralized platform of services. This strategy is often a safer middle ground by not mandating change and yet quickly solving for challenges of smaller affiliates. This can also be an interesting ‘proof of concept’ that, if successful, can later be expanded to support future consolidations.

- Outsourcing – Engage a service provider to be a strategic partner in building a consolidated middle office operating model. These solutions can be component based or full on outsourcing arrangements. Although the middle office landscape has seen conversions with varying levels of success, ultimately service providers have deep expertise and experience in managing complex integrations which is particularly important given the unique requirements of multi-affiliate models. The challenge is choosing the right partner who can align with a multi-affiliate’s strategic needs across the diverse investment teams.

In addition to assessing how middle office transformation can support the business, there is a growing interest in evaluating front-office functions. The dialogue continues to evolve in terms of assessing integrated end-to-end front, middle and back office models. This trend is resulting in further evaluation and consolidation opportunities across OMS/EMS trading platforms. Additionally, these discussions extend into evaluating whether trading desks should also be under consideration for either consolidation or possibly component outsourcing. Although the front office discussions can get very close to where an affiliate believes it adds unique value, it is increasingly an area that is in scope when we discuss middle office transformation.

Firms with multi-affiliate organizational structures have a tremendous opportunity to transform their legacy operating models. An ever-growing array of operational and technology solutions can deliver new organizational revenue and cost synergies if executed properly. Olmstead sees firms considering bolder steps in defining their own unique path to unleashing the scale of their collective enterprise while retaining the “secret sauce” that each affiliate requires to deliver on their contribution to the firm’s success.

Contact the author:

Stephen Alepa

617-905-5787